Chapter 02

Care! Why sustainability matters.

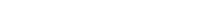

Exponential growth is what many startups strive for. In the past century, however, unparalleled economic growth has been the root cause for a lot of the environmental mess we have to deal with today and will continue even more so in the future – unless we adjust our rationale and way of doing business.

Social and ecological responsibility and economic success are not contradictory. The conditions for doing business in the 2020s have actually made sustainability a business case.

After this chapter, you…

- understand all the reasons and facts why sustainability is a business case and what the numerous benefits of building a sustainable business are

Need for sustainability grows exponentially

The past decades have seen extraordinary economic growth and wealth creation – the downside to it being a frightening loss of ecosystems and undermining of social equity.

Legislation, capital markets, and businesses have come to understand that this “destructive creation” is detrimental to any meaningful progress and are embarking on a mission to alter the rules of the game.

Sustainability has become a business case

Three – rather unusual suspects – have become main drivers for a sustainable transformation in the European economic system:

- (European) legislation, with a historically unprecedented effort and investment to drive a low-carbon and sustainable economy, e.g. driven by the EU Taxonomy Regulation

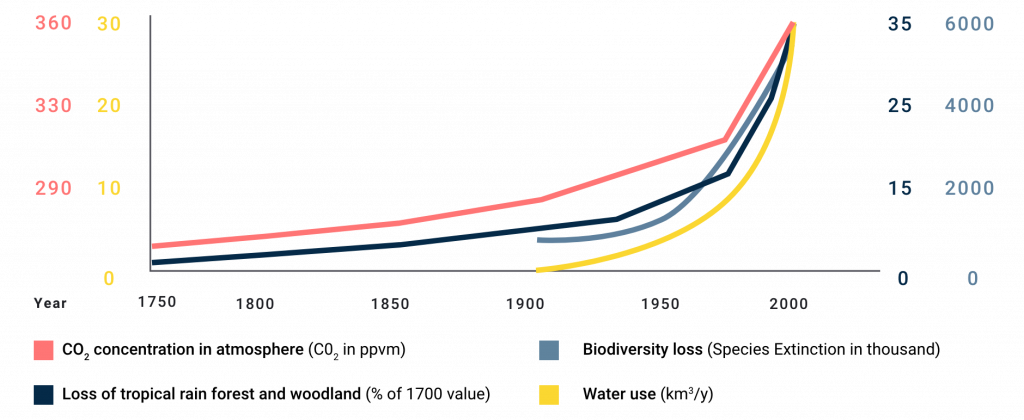

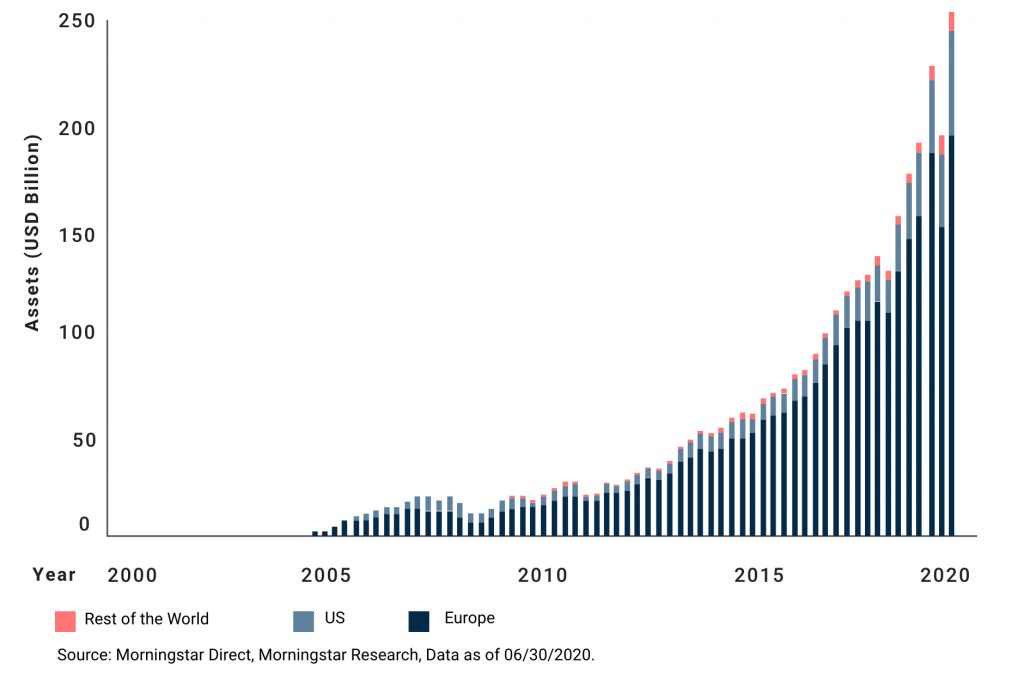

- Capital markets, reacting to the fear of stranded assets and massively devalued investments in a world shaken by natural disasters and dwindling resources

- (Mainly listed) corporations, accommodating to the two other drivers and thus shaking up everyone involved in their supply chains by demanding full transparency on social and ecological footprints

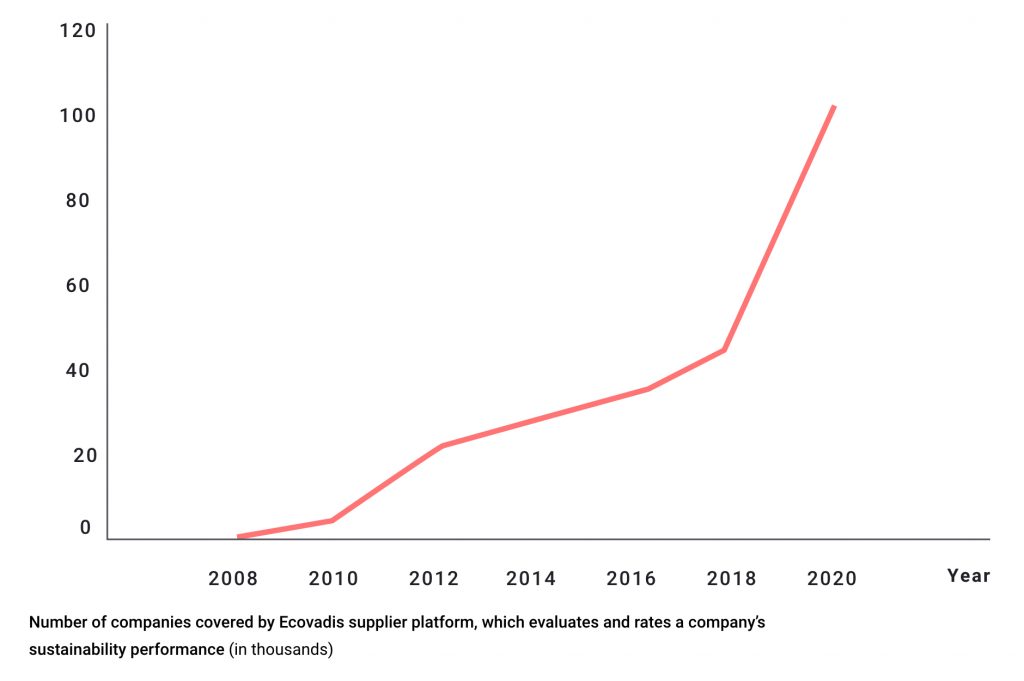

Thus, the exponential environmental crisis has created a business environment which fosters an exponentially growing demand for sustainable solutions (to buy or to invest in).

The environmental crisis has led to increasing demand for sustainable solutions

Want to dive deeper?

- Understand the urgency for bold action on sustainability: Planetary Boundaries and Doughnut Economics

- What qualifies as sustainable business activity according to the EU Taxonomy

- Learn how to tap into EU funds fostering sustainable innovation

Benefits of integrating sustainability into your business

Integrating sustainability into your business model makes perfect sense. Depending on the maturity of your business, the size of your company, or the depth of your vertical integration, you will find one or more of the following benefits of integrating sustainability.

Risk

Mitigate risks and capture opportunities from regulation

Manage risk of operations disruptions (from resource scarcity, climate-change, or community risks)

Reduce reputation risks and get credit for your actions (e.g. through proper stakeholder management)

Growth

Guide investment/divestment decisions at portfolio level based on sustainability

Develop sustainability-related products/technologies to fill needs of costumers/company

Build a better understanding of sustainability-related opportunities and new market segments/geographies and develop strategies to capture them

Returns on Capital

Improve access to financing and reduce both transaction and capital costs

Improve resource management and reduce environmental impact across supply chain and operations to reduce costs and improve products’ value propositions

Improve revenue through increased share and/or price premiums by marketing sustainability attributes

In the greater scheme of market dynamics, a positive self-reinforcing dynamic has unfolded in recent years. For once, there is significant government action with regards to policy decisions based on the United Nations’ Sustainable Development Goals (see chapter 3) as well as to the Paris Agreement to limit global warming to 1.5 or 2 degrees Celsius. At the same time, civil society and consumers demand not only from politicians but also from businesses that they contribute their fair share.

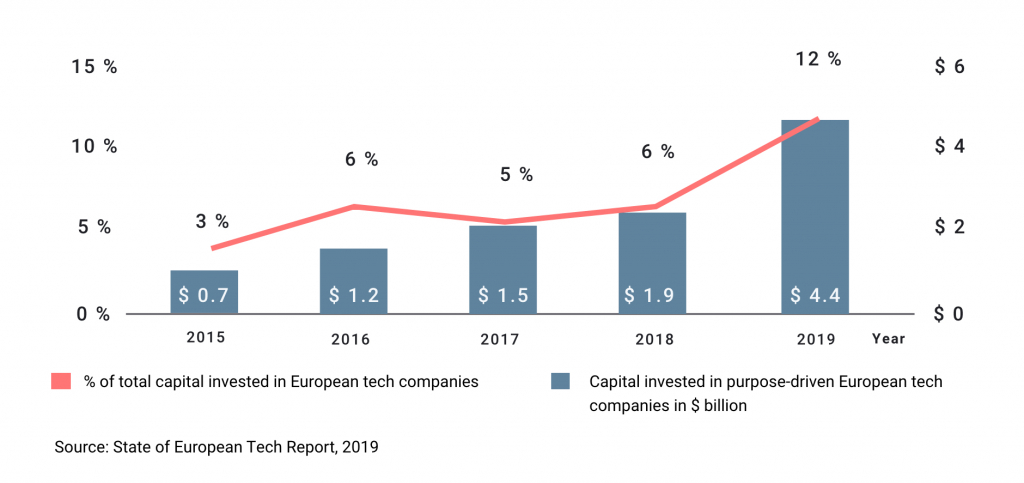

A sound sustainability strategy will become a prerequisite to receive financing: An increasing number of investors are integrating sustainability considerations into their investment decisions. Besides increasing your chances of medium to long-term success, embedding sustainability considerations will broaden your pool of potential investors in the future.

According to the 2019 Report “State of European Tech” by Atomico, total capital invested into purpose-driven companies has more than doubled compared to the previous year, totaling €4.4bn in 2019.

And then there are your current and future employees: Purpose-driven, sustainable companies can attract and retain talent much easier. It also reduces employee turnover and increases productivity.

40% of millennials (in the U.S.) have chosen a job because of a company’s sustainability, and more than 70% would take a pay cut to work at a company with strong environmental mission.

Need some more evidence?

Still skeptical about the business benefits of sustainability? Then check out this

It presents an analysis of more than 2,000 empirical studies on the correlation of sustainability and economic performance and shows that failing to anticipate and address environmental, social and governance topics in the planning and scaling of the business will affect long-term economic success.