Chapter 03

Start! Look at your investment strategy.

In their investment strategy, venture capitalists focus on specific business approaches, technologies, or industries that they think will yield the highest return (without explicitly causing harm).

We are not here to change that. However, we believe that disregarding sustainability aspects will harm your VC’s return in the long run due to emerging sustainability-related risks and downsides.

Or, to turn it around, integrating sustainability aspects into your strategy will contribute to your portfolio’s overall long-term success, and therefore, secure and improve your shareholders’ return.

Your investment strategy

The goal of this chapter is to

- raise awareness on how and to which extent sustainability aspects are already integrated into your strategy, and what kind of positive environmental or social impact you may or may not already have, and

- show you the options you have to leverage sustainability in your investment strategy as a means to ensure your long-term success.

1. Raising awareness

To figure out the first part, answer these questions:

- How do I make sure my investments don’t enable or support harmful business activities?

- Does my investment focus cover business models, technologies, or sectors, which have an explicit positive economic, social, or environmental impact?

- Does my investment focus currently include the objective to contribute to any of the 17 Sustainable Development Goals of the United Nations?

- Which impact on the planet and society do my investments currently have and what are the corresponding levers and influencing factors?

2. So, what are my options?

The leanest possible sustainability strategy is: Do no harm and exclude clear social or environmentally unethical or illegal business categories, which are harmful to the environment or have a negative social impact.

If you want to actively leverage potential ESG-related upsides in your portfolio, integrate sustainability aspects into your investment process and in your portfolio management (we’ll show you how in Chapter 5 and Chapter 6).

If you aim at thought leadership and to differentiate your VC in terms of sustainability, do the first two steps and clearly align your strategy with specific sustainability topics or specific Sustainable Development Goals to maximize your positive contribution.

A similar approach is the “Three Types of Impact” by The Impact Management Project: A (Act to avoid harm), B (Benefit stakeholders), and C (Contribute to solutions). Find more information on their approach here: How investors manage impact.

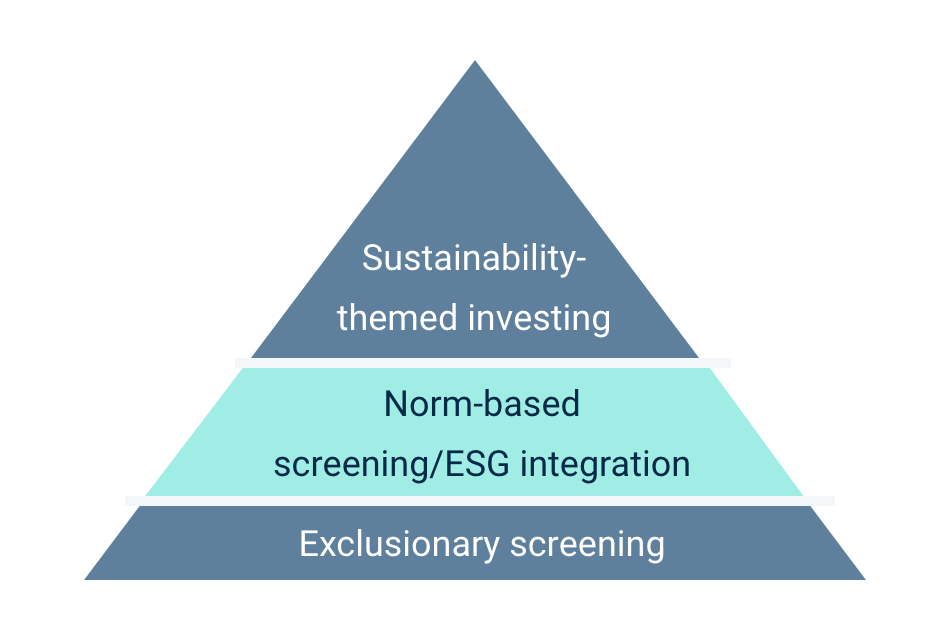

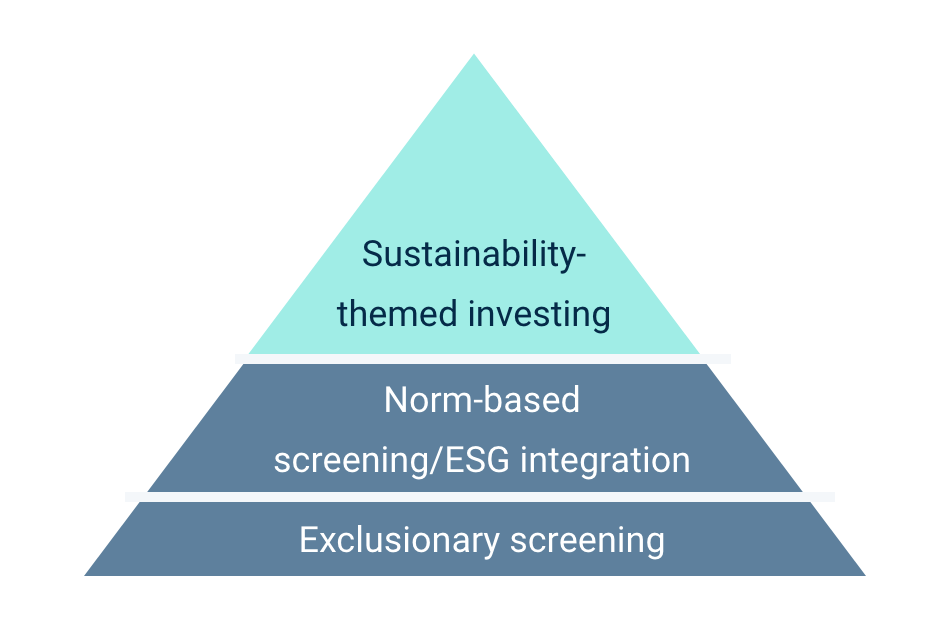

In the following, we describe these three ambition levels in more detail.

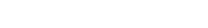

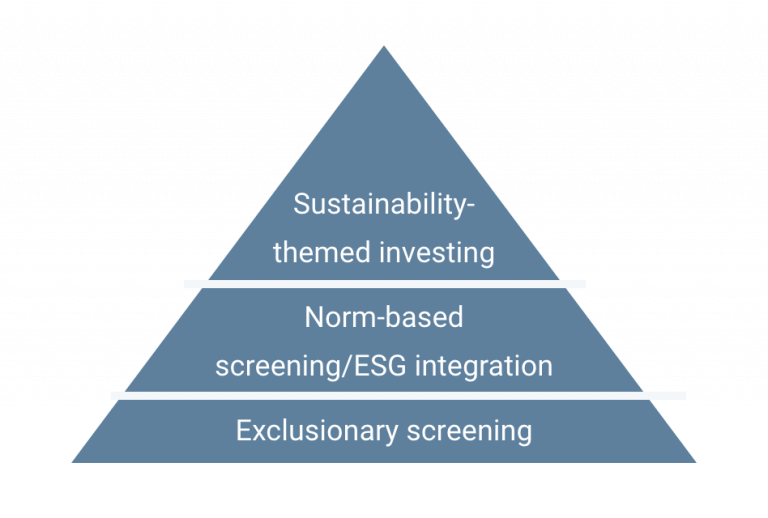

Define your sustainability ambition

A VC investment strategy most likely covers the following topics:

As your sustainability ambition determines what kind of startups you invest in, it ultimately makes up a new dimension of your strategy.

Doing the minimum:

Exclusionary screening

Most venture capitalists will already have covered the basis, i.e. not to invest in businesses violating international norms and standards and/or traditional „sin“ industries such as businesses associated with military actions / weaponry, gambling, alcohol, tobacco, pornography, etc.

The minimum you can do is to exclude certain sectors, companies, or practices from your fund or portfolio based on specific ESG criteria.

This refers to the explicit exclusion of industries and companies which

- fail to meet certain social, environmental, and governance criteria, or

- which do not fulfill the ethical claims made in their business policies, or

- which breach international norms and standards as defined by OECD, ILO, UN, and others.

Exemplary exclusion list

This list is, of course, only a rough guidance of topics / industries to exclude. You can find more sources for exclusion lists in Chapter 9.

Norm-based screening / Integration of ESG considerations

The next level is to integrate ESG criteria along your investment-related activities and processes and your day-to-day work. Chapters 4 (fundraising & LP reporting), 5 (investment process), 6 (portfolio management) and 7 (your own operations) will explain in more detail what this entails.

An important part of this sustainability ambition level is to measure and report on your sustainability activities and progress (both yourself and your portfolio companies), internally and externally, which we cover in chapter 8.

Sustainability-themed investing

We perceive that clearly committing to a specific environmental and/or social cause or to the United Nations Sustainable Development Goals (SDGs) constitutes the top of this pyramid.

This will exclude a few – only unfavourable – investments – and anyway: why would you want to invest in businesses that are not considered to contribute to a positive cause, and therefore will have a lower chance of gaining customers, attracting employees, receiving investment, and, most importantly, surviving in the long-term?

When aligning your investment strategy with a positive environmental/social mission or the SDGs, make sure to

- screen the sub-goals of the SDGs and not just use the headlines of the 17 goals as your framework

(so you avoid unintended negative impacts and fully understand the SDGs’ intentions), - identify where you expect to have the highest impact or best lever, and

- prioritize those topics which have the biggest synergies with your existing investment strategy

(if you already have one).

Other frameworks you can align your strategy with are, e.g., the Bruegel Framework by the European Think Tank Bruegel, the IRIS+ Core Metrics Set by the Global Impact Investing Network, or the Value Driver Adjustment Approach.

Key takeaways

- Think about how you can embed your sustainability ambition in your investment strategy.

- Prioritize those topics where you have the greatest impact and which have the greatest synergies with your existing strategy.

- The minimum is exclusionary screening, excluding certain sectors, companies, or practices based on ESG criteria.

- For VCs with higher ambitions: Integrate sustainability in your “value chain”, all processes, and your daily work.

- The highest ambition is to focus on “positive-impact” topics only, i.e. sustainability-themed investing.