Chapter 02

What are we talking about? A quick definition.

What do we mean when we talk about “Sustainability in Venture Capital”?

Generally, we are speaking about all aspects that help to secure any company’s long-term (“sustainable”) success, balancing economic, social, and environmental aspects.

The origins of “Sustainable Development”

The term “Sustainable Development” was coined in 1987 by the Brundtland Commission, established by the United Nations. It laid out that “Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs”.

The United Nations Global Compact, the world’s largest corporate sustainability initiative, further developed the definition of corporate sustainability, saying

Corporate sustainability is a company’s delivery of long-term value in financial, environmental, social, and ethical terms.

Sustainability in Venture Capital

So, if the inherent objective of sustainability is to contribute to business results, mitigate risk, and enhance reputation – what does this mean for VCs?

For venture capitalists, this translates into considering and integrating not only financial aspects, but also environmental and social aspects into all activities and processes, including

- the Investment Strategy,

- the Fundraising Process and LP Management,

- Investment Process,

- Portfolio Management, and

- your own operations.

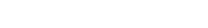

The focus of this Playbook

The focus is on commercial investors seeking to integrate sustainability, from excluding certain industries to sustainability-themed investing. What this Playbook doesn’t cover is the whole topic around “impact investing” – this would be an entire playbook in itself.

However, throughout the Playbook, we provide links and tips for further reading on impact investing as well.

Key takeaways

- Sustainability means securing any company’s long-term (“sustainable”) success by balancing economic, social, and environmental aspects.

- Sustainability in venture capital means integrating environmental and social considerations – alongside financial aspects – into all activities and processes.