Chapter 05

Stretch! Embedding sustainability in the investment process.

Embedding sustainability criteria along the entire investment process, including the initial screening criteria, the due diligence checklist, the investment memo, the term sheet, as well as – most importantly – the shareholders’ agreement is key to driving change persistently.

Integration into established processes is also the basis to leverage sustainability as a driver for long-term success of investment candidates and portfolio companies.

How to start?

Let’s start with the first step in the investment process, your screening criteria.

Step 1: Additional Investment Screening Criteria

The first step is to integrate social and environmental considerations as part of your screening criteria. Same as for your sustainability ambition of your investment strategy, you can integrate consideration of sustainability criteria on a broader level to start with. Or you can dive deeper and work with a more sophisticated approach, already assessing the specific (potential) impact or even the monetary value of the expected environmental and/or social impact created.

For a very high-level approach, here are some key criteria to integrate in your due diligence process:

- Does this startup have any harmful impacts on the planet / the environment or society through its product/service or in its value chain? (you can also the SDGs as a framework to check negative impacts on the SDGs across the entire value chain)

- Does this startup violate any of the 10 principles of the UN Global Compact?

- How severe is the negative (potential) impact and how could this be addressed in the development of the startup?

- Does this startup have a positive impact on any environmental or social issue? If yes, in what way?

- Does this startup specifically contribute to any of the SDGs(in a positive way)? If yes, to which SDGs exactly?

Hint!

If a startup does not contribute to any of the SDGs or currently only has a weak positive impact, it should not automatically be excluded.

Rather, if it is an interesting investment case for you, think about and discuss with the founding team if and how negative impacts on specific environmental, social, or governance issues can be improved to minimize their risk exposure and ensure their long-term success.

The goal should be to integrate these questions as standard questions into the screening process and discuss them alongside all other relevant investment criteria.

If you seek a more measurable approach, here are four different ways to tackle it:

Measurable Approaches

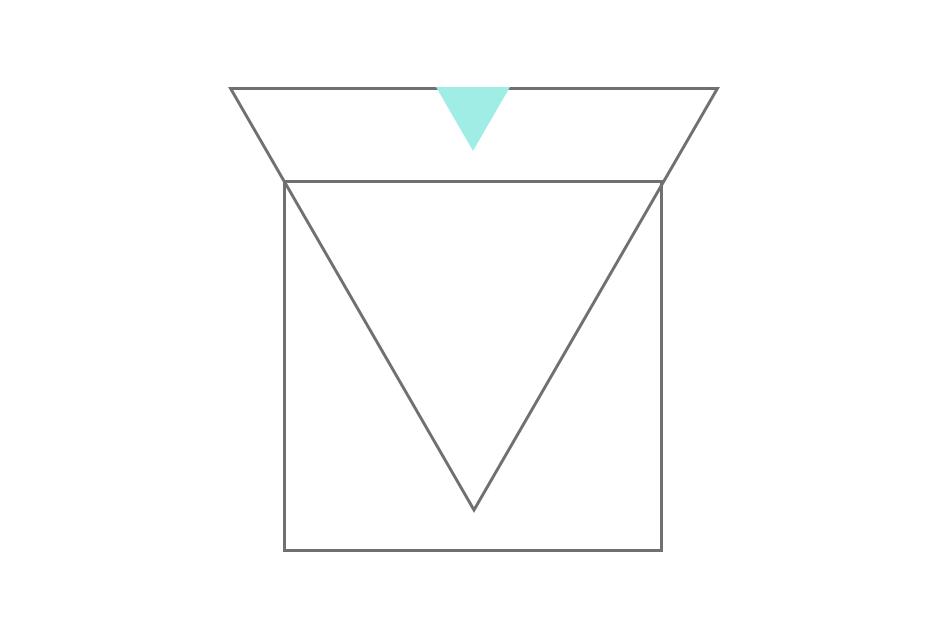

- In 2019, UVC Partners introduced an “Impact Score” for startups, assessed as part of the due diligence process.

Evaluation

- The impact of each investment candidate is evaluated regarding all 17 sustainable development goals (SDGs) of the United Nations.

Scoring

- The scoring reaches from -2 (very negative impact) to 2 (highly positive impact) per SDG, and is based on a sound assessment by the deal team.

- They only invest if the total summed score (ranging from -34 to 34 as a result of considering 17 SDGs) is positive.

- In addition, a negative score of -2 in any SDG is a “red flag” regarding an investment.

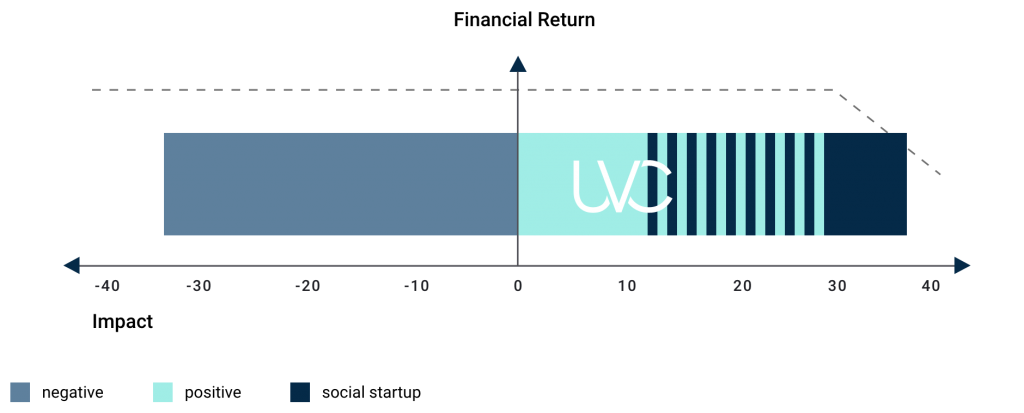

Another approach is to assess impact across five dimensions, developed by the Impact Management Project: What, who, how much, contribution and risk.

According to the Impact Management Project, the impact of an investment, or portfolio of investments, is driven by the impacts of the underlying enterprise(s)/asset(s), as well as the contribution that an investor makes to enable those impacts.

All enterprises have effects on people and the planet, positive and negative, intended and unintended. The impact of those effects can be understood by looking at performance across five dimensions, based on measurement and analysis of 15 types of data.

For more details, visit the Website of The Impact Management Project

The IMP reached goal consensus that impact can be measured across five dimensions: What, Who, How much, Contribution and Risk.

If you want to estimate the financial value of the social or environmental impact likely to result from each dollar invested right from the start, the VC “The Rise Fund”, together with Y Analytics and Bridgespan, has developed a methodology to assess the potential impact before a single dollar is committed.

The approach consists of six steps to calculate the IMM of a potential investment:

- Assessing the relevance and scale

- Identifying target social and environmental outcomes

- Estimating the economic value of those outcomes to society

- Adjusting for risks

- Estimating the terminal value

- Calculating the social return

To read more about this approach, please visit the Website of The Rise Fund.

The newly founded Impact VC Planet A Ventures developed a framework called “Impact Forecasting” to measure the potential future impact of portfolio companies on three key areas: climate change, waste, and resources.

To quantify the impact, they conduct “Life Cycle Assessments” – scientifically assessing the environmental impacts associated with all stages of a product’s or service’s life – from raw material extraction through materials processing, manufacturing, and distribution. This results in quantitative data on GHG emissions as well as plastic, water or land use footprints. By comparing the results with reference products on the market they can assess how much better a start-up’s innovation is (=improvement rate). They then forecast impact by multiplying the environmental improvement (impact perspective) with the projected growth of a company (business perspective).

Source: Planet A Ventures

As you can see, each approach takes a different angle and measures slightly different things. Almost every Impact VC has its own unique approach to measuring impact (and they have been in the game of trying to measure environmental and social impacts for a while now…).

Over time, we hope that there will emerge a standard framework for all VCs that can be applied and integrated easily to fit each investment focus.

Diversity

Portfolio diversity in terms of racial and gender makeup of founders is another important topic to consider in your initial screening process.

Read more about why it pays off to invest in diverse teams and how to increase diversity in Chapter 7 – Diversity.

Step 2: The Due Diligence Checklist and the Investment Memo

Same as for the first step, integrate the results of the questions or the preferred approach above in your due diligence checklist and investment memo. You might think that adding these questions doesn‘t change anything – they can still be ignored, and that‘s true.

But having them in there and making them a mandatory part of every screening process and team discussions will change awareness around these issues, and, ultimately, lead to better investment decisions.

Step 3: The Term Sheet and Shareholder Agreement

The term sheet outlines the material terms and conditions which the shareholder agreement is later based on. As such, integrating sustainability aspects demonstrates your ambitions and values to your investment targets early on. These, of course, need to be transferred into the shareholder agreement to become effective and legally binding.

Please note: Don’t add standard targets or topics in the term sheet and the shareholder agreement.

Rather, secure the startup’s commitment to

- identify their material sustainability issues,

- set clear goals to make progress on these issues, and to

- measure and report on their progress in board meetings – at least on a yearly basis.

Further information on these steps can be found in Chapter 6 – Managing Sustainability in Your Portfolio Companies.

On the right you can download some exemplary term sheet clauses on sustainability.

Startups in a VC portfolio are typically very heterogeneous, so a standardized framework is of limited use. Rather, each startup needs a tailored ESG strategy in line with their goals, industry and business approach.

Why not add specific topics into the Term Sheet and Shareholder Agreement?

Whether you are a producing company or a software company, whether you are in the automotive industry or the banking sector, you will be faced with very different topics that are relevant (=material) to you.

Each startup needs to go through the exercise to identify their material issues to make sure they are working on the right topics. This will also ensure the startup’s buy-in to work on and make progress on these topics.

We believe it is more powerful to commit to work on individual material sustainability topics rather than focusing on arbitrary topics, e.g. reducing CO2 or waste, which might not be the most material topic to the startup!

In the end, the founders are the ones who need to drive these topics and implement them, so they need to be convinced of the business synergies and upsides.

Checklist:

Sustainability aspects need to be part of every step in the investment process

- Initial Screening Criteria

- Due Diligence Checklist

- Investment Memo

- Term Sheet

- Shareholder Agreement

Key takeaways

- Integrate sustainability aspects into all steps of the investment process.

- If a startup doesn’t pass the sustainability criteria but is an interesting investment case overall, discuss with the founders how they can become more sustainable.

- Integrating sustainability criteria in the investment process does not make a startup sustainable yet, but raises awareness on these issues and ultimately leads to better investment decisions.

- Do not add clauses on standard topics in contractual documents, but secure the startup’s commitment to work and improve on its material sustainability issues.

To conclude: Integrating sustainability aspects into all steps of the investment process is an important lever.

More importantly, though, is working together with your investments on these issues, to guide and support them along their sustainability journey, and to make sure your investments are set up for long-term success.

How to do that? Read Chapter 6.