Chapter 01

Introduction: Why we need to take action.

We are at a critical point in our time. Climate change, social injustice, resource shortages – to name only a few of the global challenges we are currently facing – require new and radical solutions to secure a prosperous life for future generations.

We believe startups are a driving force of sustainable innovation and that venture capital firms have the levers and the means to drive this sustainable transformation.

We believe now is the right time, even more so with COVID-19 and the transformation and reconstruction of economies to change the way of doing business. For investors, it is time to step up.

Why sustainability matters

Exponential growth is what many startups strive for. In the past century, however, unparalleled economic growth has been the root cause for a lot of the environmental mess we have to deal with today and will continue even more so in the future – unless we adjust our rationale and way of doing business.

Socially and ecologically sound practices and wealth creation do not need to be contradictory. The conditions for doing business in the 2020ies have made sustainability a business case.

Larry Fink, CEO of BlackRock, in his 2020 letter to CEOs (January 2020):

Our investment conviction is that sustainability- and climate-integrated portfolios can provide better risk-adjusted returns to investors. And with the impact of sustainability on investment returns increasing, we believe that sustainable investing is the strongest foundation for client portfolios going forward.

Sustainable Investing is Sweeping Across the Globe

Sustainable investing will become the new normal. One big driver is surely the EU with the EU Taxonomy Regulation regarding sustainability-related disclosures in the financial services sector, aiming to define minimum criteria economic activities need to comply with to be considered environmentally sustainable.

And while this boom is clearly visible among institutional investments, where investors are starting to re-evaluate traditional portfolio approaches and putting sustainability at the top of their agenda, this development is now slowly trickling down to venture capital, too.

Not convinced yet?

Read more here:

- Visual Capitalist: Visualizing the Global Rise of Sustainable Investing

- CNBC: Money moving into environmental funds shatters previous record

- McKinsey & Company: Sustainable investing as the new normal

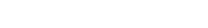

Total capital invested into purpose-driven companies in Europe has more than doubled compared to the previous year, totaling €4.4bn in 2019 (see graphic below).

Climate-related technology investments may be the biggest driver: Globally, investors poured $36bn into climate-tech investments in 2019, more than double compared to 2015, according to the research firm the Cleantech Group.

Sustainability has become a business case

Three – rather unusual suspects – have become main drivers for a sustainable transformation in the European Economic System:

- (European) legislation, with a historically unprecedented effort and investment to drive a low-carbon and sustainable economy, e.g. driven by the EU Taxonomy Regulation

- Capital markets, reacting to the fear of stranded assets and massively devalued investments in a world shaken by natural disasters and dwindling resources

- (Mainly listed) Corporations, bowing to the pressure of the two other drivers and taking to sustainability as a chance to profit from new regulations and capital market requirements, shaking up everyone involved in their supply chains by demanding full transparency on social and ecological footprints

In addition, Limited Partners are starting to push towards higher awareness of sustainability. As a consequence, Europe is best positioned to lead in developing a sustainability framework for investors, including venture capital investors.

European investors are keen to set the tone on this: more and more Private Equity Firms and VCs are rethinking their fund and investment strategies and are raising new funds dedicated to a clear mission.

Mainstream VCs moving into the impact space

Conclusion

While the facts and trends are clear, we also strongly believe investors do not only have the leverage, but also the responsibility to drive a better balance of economic, as well as environmental, social, and governance (ESG) issues.

What is ESG?

Environmental, Social, and Corporate Governance (ESG) refers to the three central aspects to measure the sustainability of a company. These criteria help to determine the future financial performance of a company in terms of return and risk.

We have identified five levers to address sustainability holistically for VCs in the following chapters:

- the Investment Strategy,

- the Fundraising Process and LP Management,

- Investment Process,

- Portfolio Management, and

- your own operations.

Our goal

We strive to advance the whole VC industry, establish new standards, make sustainability mainstream and a core value of every startup, regardless of its product/service, so you, as a VC, can contribute your share in creating a world we – and future generations – want to live in.

Key Takeaways – Why Sustainability Matters!

- The conditions for doing business in the 2020ies have made sustainability a business case.

- Investors are starting to re-evaluate traditional portfolio approaches and putting sustainability at the top of their agenda.

- Total capital invested into purpose-driven companies is increasing rapidly.

- Companies that acknowledge sustainability will emerge as the winners of the next decade.